Are you 17 and itching to get your first car? Or perhaps you’re a parent wondering if your teenager can have a car legally registered in their name?

The thrill of owning your first vehicle is unmatched, offering a sense of freedom and independence. But before you hit the open road, there’s a burning question: Can a 17-year-old legally register a car in their name? Understanding the ins and outs of car registration for teenagers is crucial.

Not only can it affect your insurance rates, but it can also have legal implications. We’ll unravel the mystery surrounding car registration for minors. We’ll delve into the rules, exceptions, and everything else you need to know to make an informed decision. Stay with us as we explore this topic, ensuring you don’t miss a crucial step in your journey to car ownership. Your road to independence could be closer than you think!

Table of Contents

ToggleAge Requirements For Vehicle Registration

Understanding the age requirements for vehicle registration can be both exciting and daunting, especially if you’re 17 and eager to get your first car. The thrill of driving your own vehicle is palpable, yet you might be wondering if you’re eligible to register it in your name. This guide will help you navigate through the specifics, so you can hit the road with confidence.

Understanding Legal Age Limits

Each state has its own rules when it comes to registering a vehicle, and age is one of the significant factors. Generally, most states set the legal age for car registration at 18. However, some states allow 17-year-olds to register a car if they meet specific conditions, such as having parental consent.

If you’re 17, you might need a parent’s or guardian’s help. Many states require minors to have a co-signer to complete the registration process. This means your parent or guardian will share the responsibility for the vehicle, ensuring you’re covered legally.

Insurance Requirements

Insurance is another critical aspect of registering a car. At 17, you might find that insurance companies have stricter requirements or higher premiums. Often, being added to your parent’s insurance policy can be a cost-effective solution. Have you considered how your driving record might impact your insurance rates?

Financial Responsibility

Owning a car at 17 is not just about driving freedom; it’s a financial commitment. Are you prepared for the costs of maintenance, insurance, and registration fees? Having a clear understanding of these expenses will help you manage your budget effectively.

Checking State-specific Laws

The rules vary widely depending on where you live. It’s crucial to check your state’s Department of Motor Vehicles (DMV) website or contact them directly. They can provide the most accurate and up-to-date information on age requirements and other relevant details.

Owning a car at 17 can be a fantastic step towards independence. It’s essential to know the requirements and responsibilities involved. Have you thought about how this could impact your daily life and freedom? Understanding these aspects can help you make an informed decision.

Legal Restrictions For Minors

A 17-year-old may face difficulties registering a car in their name due to legal age restrictions. Many states require individuals to be 18 to enter into binding contracts, including car ownership. Exceptions might exist, so checking local laws is essential.

Navigating the world of car ownership can be tricky for anyone, but for minors, the road is even more winding. If you’re 17 and dreaming of having your own set of wheels, you may be curious about the legal restrictions that could stand in your way. Understanding these limitations is crucial because getting it wrong can lead to unexpected surprises, and not the good kind. Can a 17-year-old really register a car in their name? Let’s explore the legal restrictions for minors.

Age Requirements

In most states, the age of majority is 18, which means you might face hurdles when trying to register a car at 17. Some states allow minors to register vehicles, but they often require a parent or guardian to co-sign. This is because contracts, like those needed for car registration, are not legally binding for those under 18.

Financial Responsibility

Are you ready for the financial responsibility that comes with car ownership? States typically require proof of financial responsibility, like car insurance. Insurance companies may charge higher rates for minors, making it important to budget carefully.

State-specific Laws

Each state has its own set of rules regarding car registration for minors. For example, in California, you need a parent to co-sign, while in Texas, you might be able to register the car in your name with sufficient proof of insurance. Understanding your state’s specific laws can save you a lot of time and hassle.

Parental Consent

Even if your state allows you to register a car at 17, parental consent is often a requirement. This means having a parent or guardian involved in the process, which can be both a blessing and a challenge. Are your parents supportive of this decision, and are they willing to put their name on the line?

Practical Considerations

Beyond legalities, think about the practical aspects. Can you afford maintenance, insurance, and gas? Is there a reliable way for you to manage these expenses while possibly juggling school and other commitments? These considerations are just as important as the legal ones. Understanding these legal restrictions can help you make informed decisions. Are you ready to take on this responsibility? Knowing what to expect and preparing accordingly can make the journey smoother.

State-specific Regulations

Navigating the maze of car ownership as a 17-year-old can feel like a rite of passage. But did you know the rules vary depending on where you live? State-specific regulations often dictate whether you can register a car in your name at 17. Understanding these regulations is key to ensuring you’re on the right track. Let’s dive into what you need to know.

Age Requirements And Exceptions

In some states, you might be eligible to register a car at 17, but there are exceptions. Some states allow it only if you’re emancipated or have parental consent. Even with consent, certain conditions might need to be met.

It’s crucial to check your state’s Department of Motor Vehicles (DMV) website. This will give you the most accurate and updated information. Don’t assume that your friend’s experience in another state will apply to you.

Insurance Implications

Registering a car isn’t just about having a title in your name. You also need insurance, and here’s where things get tricky for 17-year-olds. Many insurers consider drivers under 18 as high-risk, which can affect your premiums.

Some states may require a parent or guardian to co-sign the insurance policy. This means their driving record might impact your insurance rates. Are you prepared to navigate these conversations with your parents?

Legal Responsibilities

Registering a car comes with responsibilities, especially if you’re under 18. In some states, your parents might still be held accountable for your actions on the road. This legal obligation can impact their decision to allow you to register a car in your name.

Understanding these responsibilities can help you make informed choices. Do you feel ready to handle the consequences of your actions? Having this conversation with your parents is a good start.

Examples From Different States

Consider California, where you can register a car at 17 with parental consent. Contrast this with New York, where the age of majority is 18, making it more difficult for minors to register a car without being emancipated.

Each state has its quirks and rules. Knowing these can save you time and potential headaches. Have you checked out your state’s specific requirements yet?

Understanding state-specific regulations can empower you to make better decisions. Always keep communication open with your parents and consult your local DMV for guidance. Are you ready to take this step towards independence?

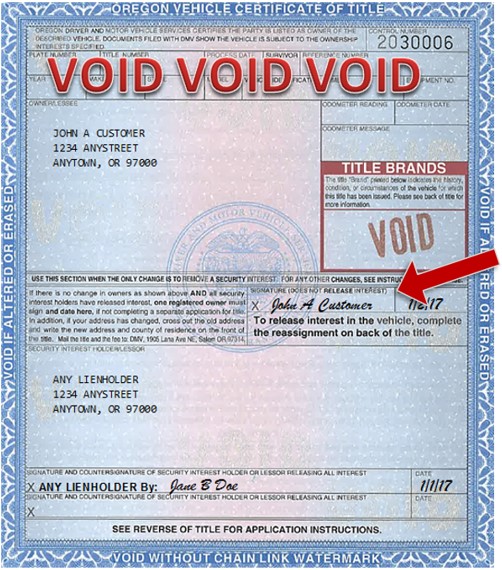

Credit: www.oregon.gov

Parental Consent And Co-signing

A 17-year-old might face challenges registering a car without parental consent. Often, a parent must co-sign due to legal age restrictions. Understanding these requirements is crucial for young drivers eager to own a vehicle.

Registering a car in your name as a 17-year-old can be a thrilling milestone. However, it often requires navigating the waters of parental consent and co-signing. These elements can be both empowering and restrictive, as they involve legal and financial considerations that are crucial to understand.

Parental Consent

Getting your parents’ approval is typically the first step. Many states require minors to have parental consent to register a car. Imagine sitting down with your parents, discussing the excitement of owning a car. It’s not just about saying yes, but understanding responsibilities like insurance and maintenance. Parental consent ensures that your parents are aware and supportive of your decision. It also gives them a chance to discuss the financial aspects involved.

Co-signing

If you’re considering financing your vehicle, co-signing might come into play. Do you know how this impacts your financial future? A co-signer is someone who agrees to share the responsibility of your loan. Often, this is a parent or guardian who has a stronger credit history. Having a co-signer can improve your chances of loan approval. However, it also means that if you miss payments, their credit is affected too.

Balancing Independence With Support

Owning a car at 17 is a step towards independence. Yet, it also means balancing that with the support you receive from your parents. You might feel ready to handle the car’s responsibilities, but remember that parental consent and co-signing are there to guide you. Would you be comfortable discussing the financial implications with your parents? This conversation is vital for setting realistic expectations.

Is Co-signing Always Necessary?

While co-signing can be helpful, it isn’t always mandatory. If you have savings to buy a car outright, you might not need a co-signer. Consider if your financial situation allows you to register the car independently. This could be an empowering step towards financial responsibility. However, if financing is needed, a co-signer might be the bridge to owning your dream car.

Exploring Your Options

Before you rush into decisions, explore your options. Research your state’s requirements for minors registering cars. Talk to your parents about what consent and co-signing mean for your future. Are there alternative paths to registering the car? Understanding these dynamics can help you make informed choices. It’s about finding the balance between youthful excitement and mature responsibility.

Insurance Considerations For Young Drivers

Seventeen-year-olds can register a car in their name, but it varies by state. Some states require a co-signer or guardian’s consent. Understanding local regulations is crucial for young drivers.

Navigating the world of car insurance as a young driver can feel overwhelming. You may wonder how insurance works if you’re a 17-year-old looking to register a car in your name. Understanding insurance considerations is crucial, not just for legality, but also for your financial security.

Understanding The Cost Of Insurance For Young Drivers

Insurance premiums for young drivers can be steep. Many factors influence this, including age, driving experience, and the type of car. You might find it surprising that a newer car can sometimes lead to lower insurance costs if it has advanced safety features.

Types Of Coverage You Might Need

Liability coverage is typically required by law. This covers damages you may cause to others in an accident. However, consider adding comprehensive or collision coverage to protect against theft, vandalism, or non-collision-related damage to your vehicle.

How To Save On Car Insurance

Look for discounts. Many insurance companies offer discounts for good grades, completing a driver’s education course, or having a safe driving record. Bundling your car insurance with other types of insurance, like home or renters, can also lead to savings.

Why Comparing Quotes Is Essential

Don’t settle for the first insurance quote you receive. Different companies offer different rates, even for the same coverage. Comparing quotes from multiple insurers can lead to significant savings and better coverage options.

The Role Of Parental Involvement

If you’re under 18, you might need a parent or guardian to co-sign the insurance policy. This can sometimes lead to lower premiums, as the insurance company considers the parent’s driving history as well. Have you thought about how this could help you save money?

Long-term Benefits Of Building A Driving Record Early

Starting your driving record at 17 can have long-term advantages. A clean record over several years can lead to lower premiums as you get older. It’s like building credit; the sooner you start, the better your financial standing in the future. Understanding these considerations can empower you as a young driver. Making informed decisions about car insurance now can save you money and stress in the long run. What are your thoughts on these strategies? How do you plan to manage your car insurance?

Financial Responsibility Laws

Financial responsibility laws play a crucial role in car ownership. These laws ensure drivers can cover damages in case of an accident. They vary from state to state, affecting car registration rules for teenagers. A 17-year-old looking to register a car might face certain requirements under these laws.

Understanding Financial Responsibility Laws

These laws mandate proof of ability to pay for damages. Insurance is the most common proof. It protects against financial losses from accidents. Parents often help minors meet these requirements. A teen might need parental consent to buy insurance.

Impact On Teen Car Registration

Financial responsibility laws can restrict car registration for teens. Many states require a minimum age for car ownership. This age often aligns with the age of legal adulthood. Teens might need a co-signer, usually a parent, for registration.

Insurance Requirements

Insurance is essential under financial responsibility laws. A 17-year-old must have insurance to register a car. Insurance companies might charge higher rates for young drivers. Parents can add teens to their existing policies to lower costs.

Each state has unique financial responsibility laws. Some states allow teens to register cars with parental approval. Others require teens to be 18 or older. Researching state laws is crucial for understanding registration rules.

Parental Involvement

Parents play a key role in teen car registration. They might need to co-sign insurance policies. Parents can also offer guidance on financial responsibility. This involvement ensures compliance with state laws.

Alternative Options For Vehicle Ownership

Owning a vehicle as a teenager is an exciting prospect, but registering a car in your name at 17 can pose some challenges. While laws vary by state, most require you to be 18 to register a car independently. However, don’t be disheartened. There are several alternative options available that can help you enjoy the freedom of having your own car. Whether it’s sharing ownership with a parent or exploring lease possibilities, you have choices that can make your dream a reality.

Shared Ownership With Parents

One practical approach is shared ownership with your parents. By having them co-sign or register the vehicle in their name, you can still use the car. This option often makes sense financially as parents can help cover insurance costs, which are typically higher for younger drivers.

Imagine the convenience of knowing someone is there to support you in case of maintenance issues or unexpected expenses. It’s like having a safety net while you learn the ropes of car ownership.

Parental Co-signature On Loans

Another route is having your parents co-sign on a car loan. This can be a win-win situation. You get the car you want while building your credit history. Just ensure you’re responsible with payments to avoid straining relationships or financial mishaps.

Think about the long-term benefits of establishing good credit early. It’s a valuable asset for future financial endeavors like renting an apartment or getting a credit card.

Leasing A Vehicle

Leasing a vehicle can also be a smart choice for teenagers. Some car dealerships offer leasing options for young drivers, sometimes requiring parental involvement. Leasing can be less financially daunting than buying outright, with lower monthly payments and maintenance included.

Leasing gives you the chance to drive a newer model car, which often comes with better fuel efficiency and advanced safety features. It’s an opportunity to experience the latest in automotive technology without long-term commitment.

Using A Guardian’s Car

Using a guardian’s car is another option. They can add you to their insurance policy, allowing you to drive without needing to own a car outright. This arrangement can be less expensive and can teach you about responsibility and sharing resources.

Picture the peace of mind that comes from knowing you’re covered under an established insurance policy while gaining driving experience. It’s a practical way to ease into the responsibilities of car ownership.

As you consider these options, ask yourself: which path best fits your lifestyle and financial situation? The right choice can set you on a smooth road to independence and adventure, all while keeping your dreams within reach.

Credit: www.progressive.com

Frequently Asked Questions

Can A 17-year-old Own A Car Legally?

Yes, a 17-year-old can legally own a car in most states. However, registering it might require parental consent. Laws vary by location, so it’s essential to check local regulations. Some states might impose additional requirements for minors, such as proof of insurance or a co-signer.

What Documents Are Needed For Car Registration?

To register a car, you’ll need a driver’s license, proof of insurance, and the vehicle’s title. A 17-year-old may need parental consent and additional identification. Requirements can vary by state, so it’s best to check with your local DMV for specific documentation needed.

Can Minors Insure A Car In Their Name?

Minors can often insure a car, but parental involvement is usually required. Insurance companies may require a parent or guardian to co-sign. Rates might be higher due to age. It’s crucial to shop around for the best policy and ensure compliance with local insurance laws.

Are There Age Restrictions For Car Ownership?

While there are no strict age restrictions for car ownership, registration might require adult consent. A 17-year-old can own a car, but legal hurdles might arise. State laws differ, so it’s important to understand local requirements and ensure all paperwork is correctly handled.

Conclusion

Understanding car registration rules is essential for young drivers. Each state has its own laws. Some allow 17-year-olds to register cars. Others require adult assistance. Checking local regulations is crucial. Parents or guardians can provide support. Preparing necessary documents helps avoid delays.

Always ensure insurance is in place. Driving is a big responsibility. It’s important to follow the law. Being informed makes the process smoother. Young drivers should explore options thoroughly. Taking these steps ensures legal and safe driving.